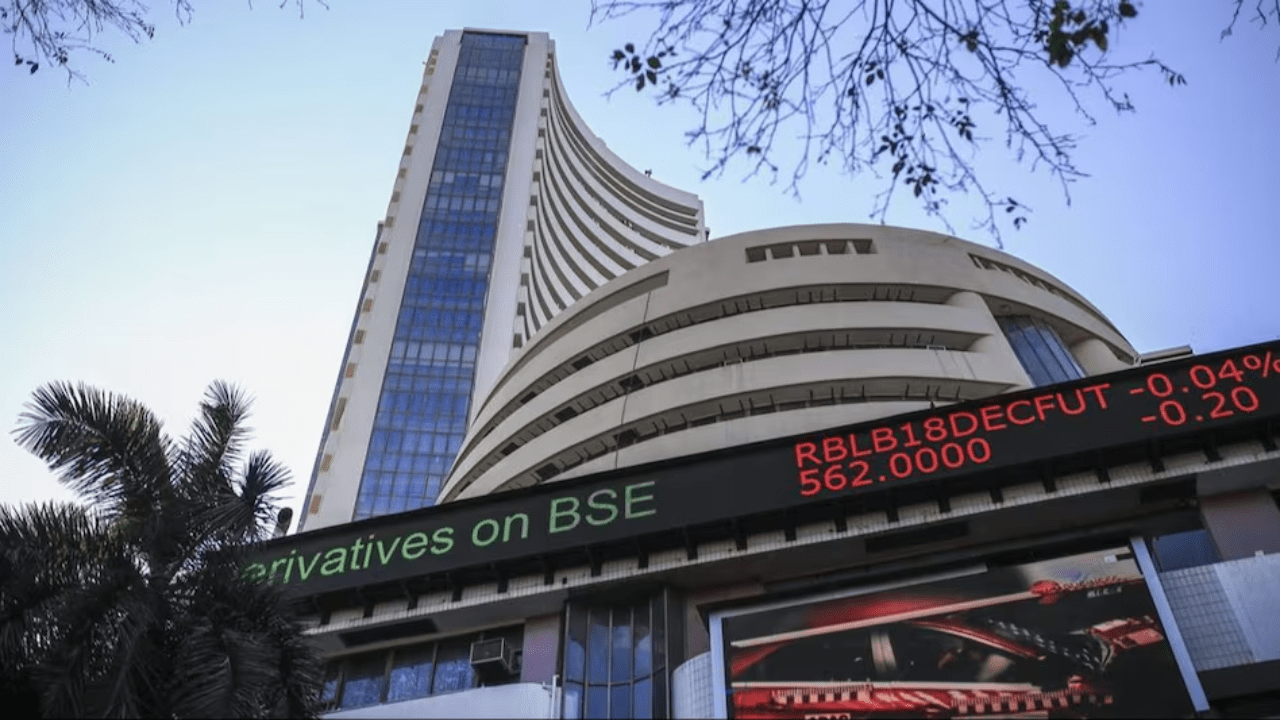

Bombay Stock Exchange’s (BSE) headline 66.6% share “crash” on May 23, 2025, was purely a mechanical adjustment following its 2:1 bonus issue—and not a collapse in investor confidence. When a company issues two additional fully paid ₹2 shares for each existing share, the ex‐bonus price automatically recalibrates to one‐third of its pre‐bonus level. Thus, BSE’s stock adjusted from around ₹7,000 to approximately ₹2,335 on the National Stock Exchange, even as overall market capitalization remained unchanged.

In fact, once the bonus shares began trading, the stock rallied: BSE shares rose about 2.3% intraday to a high of ₹2,389, signaling robust buying interest. To qualify, investors needed to hold shares by the record date of May 23—meaning they had to buy by May 22 under T+1 settlement rules. The bonus shares are deemed allotted on May 26 and will start trading from May 27, effectively tripling shareholders’ holdings without additional cash outlay.

This marks only BSE’s second bonus issue—the first was in March 2022—and comes on the back of a stellar run: a 176.8% gain over the past year and a 17.8% rise just in the last month. Far from a sign of weakness, the bonus issue rewards long‐term investors, enhances liquidity by lowering the per‐share price, and broadens access for retail participants, all while preserving the exchange’s overall valuation.